Sapphire Reserve Foreign Transaction Fees

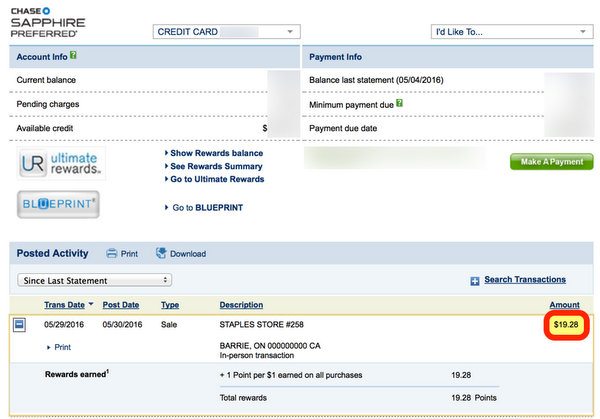

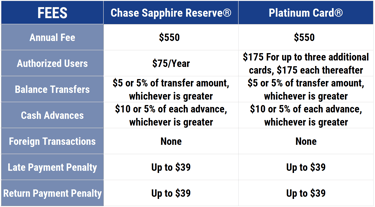

The chase sapphire preferred card which is a top travel rewards card has a 95 annual fee.

Sapphire reserve foreign transaction fees. Is it still worthwhile to open the card. Will not be subject to foreign transaction fees. Chase sapphire foreign transaction fee. Purchases made with these credit cards outside the u s.

But by not paying foreign transaction fees you d only need to spend about 3 200 outside the u s. The chase sapphire reserve doesn t charge foreign transaction fees for any purchases you make abroad. Travel with a no foreign transaction fee credit card from chase. Same page link to pricing and terms for example if you spend 5 000 internationally you would avoid 150 in foreign transaction fees.

Chase sapphire cards are popular choices for travelers as both chase sapphire preferred and reserve have 0 foreign transaction fee. Bottom line chase sapphire reserve foreign transaction fees. If you can t decide between the chase sapphire preferred card and its big brother the chase sapphire reserve you should probably go for the preferred. The chase sapphire reserve card is a great option to use when you re outside of the us because it does not charge international fees.

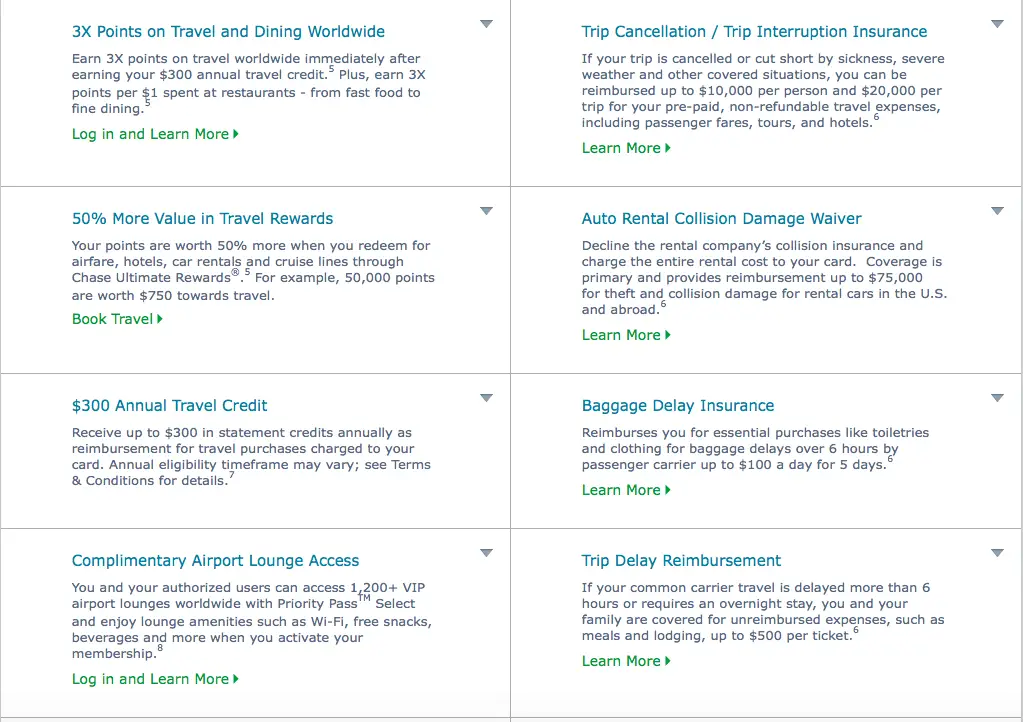

To offset the annual fee compared to what you would pay if your card had a 3 percent foreign transaction fee. When traveling overseas it s important to choose a card with no foreign transaction fees. Both offer bonus points extra points for travel and dining and premium travel benefits. It offers purchase protection basically insurance for your purchases and extended.

3x points on travel immediately after earning your 300 travel credit. You will pay no foreign transaction fees when you use your card for purchases made outside the united states. 0 foreign transaction fees.

/images/2019/05/05/woman-at-international-airport-thinking-of-foreign-transaction-fees.jpg)