Satellite Radio Business Expense

Is xm radio a common and accepted expense in your trade.

Satellite radio business expense. I use it to listen to the business station and sexual health broadcast as i am a independent consultant for pure romance. Companies must pay for satellite bandwidth just like cell phone owners must pay to transmit voice and data. To the extent that you use the onstar vehicle service for business purposes it would be deductible. I use it to listen to the business station and sexual health broadcast as i am a independent consultant for pure romance.

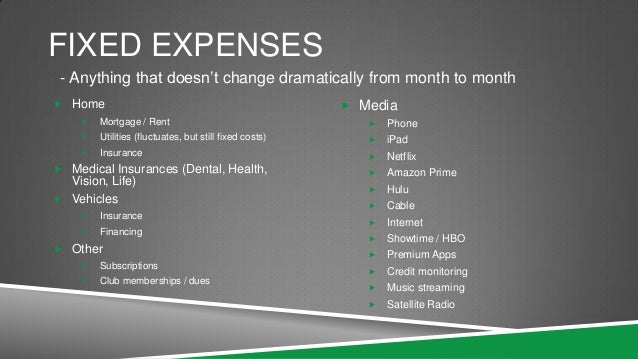

Many drivers are not aware of this but satellite radio expenses are tax deductible. Offer details the music for business subscription plan you choose will automatically renew thereafter and you will be charged according to your chosen payment method at then current rates fees and taxes apply. Sign up for a free streaming trial. To cancel you must contact your reseller.

Satellite radio subscriptions would generally be considered personal. Then there s the expense of maintaining and repairing satellites. As a result of large capital investments in our satellite radio system our results of operations reflect significant charges for depreciation expense. A typical weather satellite carries a price tag of 290 million.

Get 150 streaming music latest news sports news talk radio stations. I can think of few situations where it would be deemed as such and yours unfortunately does not sound like it. Say thanks by clicking the thumb icon in a post. For questions call 1 866 345 7474 see our customer agreement for business establishment services for complete terms.

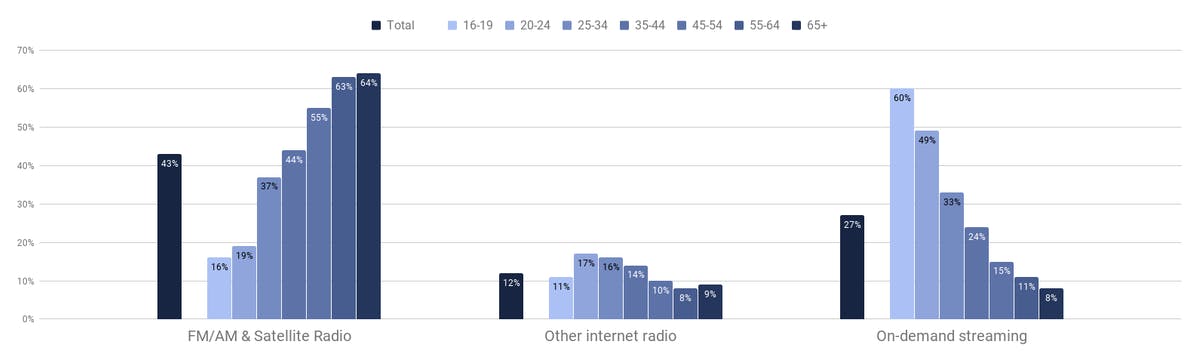

We believe the exclusion of share based payment expense is useful as it is not directly related to the operational conditions of our business. Stream radio online or in your car w siriusxm. Since a driver can use it as a tool for weather and traffic information a business need for. The two companies spent over 3 billion combined to develop satellite radio technology build and launch the satellites and for various other business expenses.

In the best of scenarios you would need to keep detailed records of the business use of the service and claim the expense on a pro rata basis then apply the 50 limit to the.

/GettyImages-901831728-20953dfd69db45fe99b260a4593c73f4.jpg)